The Town of Point Roberts, Part 1

Last August, after Auntie Pam’s Store was broken into, there was some talk about Point Roberts becoming self-governing. Questions were also raised about whether we get our fair share of services for the taxes we pay. So we took a look at our property taxes to see how we felt about that balance - were they fair, or off kilter?

When traditional newspapers report about tax increases, levies, expenditures, and so forth, the assumption is that readers already understand all the context required to make sense of that news. But how many of us really understand how Point Roberts services are funded, how the county is funded, and what the relationship between the two is? It's complicated, so we decided to try to make sense of it to ourselves. Here's what we came up with.

Washington is only one of seven states that do not have a personal income tax. (The others are Alaska, Florida, Nevada, South Dakota, Texas, and Wyoming.) That means government services here are funded through a kind of pay-as-you-go system of usage taxes. If you own property, you pay property taxes. If you buy something (other than most groceries), you pay a sales tax. If you have a driver’s license, own a car or a boat, or buy gasoline for your vehicle, you pay taxes specifically to support the departments that oversee those things and the related infrastructure. If you want to build something, you pay a fee for a permit that covers inspections and other services related to building. If you commit a crime, you pay a fine or penalty that helps defray some of the costs for the court system and your incarceration.

The biggest, and some believe most equitable, “usage tax” is property taxes. If you own real property in Point Roberts, its value is determined by the Whatcom County Assessor. Related taxes are billed and collected by the Whatcom County Treasurer. You can find out exactly how much you pay by looking up your property here.

Below is a very simplistic look at property taxes only for all of Whatcom County and then Point Roberts specifically. (For Point Roberts, we exclude the assessments for garbage collection and on-site sewage.) Our focus is on property taxes because we can literally see who pays what, and it is solely based on the value of one's property. While you can see how much revenue is generated by retail sales tax, you do not know how much each individual paid.

These are all the property taxes levied for all of Whatcom County by fund, from the Whatcom County Assessor's Tax Book 2019. We denote key points, which are explained below:

Here's a summary description of what some of these categories are:

Here's our version of the Point Roberts component of the county property taxes. In the table below, we reorganize the categories above to separate out the funds which are collected from Point Roberts and directly returned to us, those that go into county-wide buckets, and schools. We also show the amount of levies per one hundred thousand dollars for an individual level, and for Point Roberts overall. Our numbers may be off by a few dollars due to rounding errors:

| These are the taxes that appear on your property tax statement if you own property in Point Roberts | This is the amount of tax you pay per $100,000 of your property’s value | This is the amount of tax paid by Point Roberts overall, based on the valuation of all real property in Point Roberts, which is about $625,450,388* |

|---|---|---|

| Funds for Point Roberts taxing districts, 100% of which is returned to Point Roberts | ||

| Cemetery Dist. #8 | 1.03 | 6,442.14 |

| PR Parks and Rec. #1 | 26.53 | 165,931.99 |

| PR Hospital Dist. | 43.11 | 269,631.66 |

| PR Fire Dist. #5 | 97.02 | 606,811.97 |

| Total PR taxes | 167.69 | 1,048,817.76 |

| Funds for countywide expenditures - revenue is spent both here in PR and in the rest of Whatcom County | ||

| Whatcom County General Fund | 94.63 | 591,863.70 |

| County Road Dist. | 133.27 | 833,537.73 |

| Flood Control | 15.08 | 94,317.92 |

| Conservation Futures | 3.50 | 21,890.76 |

| Rural Library Dist. | 43.40 | 271,445.47 |

| Port of Bellingham | 22.76 | 142,352.51 |

| Whatcom Cty. EMS | 25.36 | 158,614.22 |

| Total countywide taxes | 338.00 | 1,522,158.61 |

| Schools | ||

| State School | 276.36 | 1,728,494.69 |

| Blaine School Dist. #503 | 260.78 | 1,631,049.52 |

| Schools total | 537.14 | 3,359,544.21 |

| Approximate total property tax | 1,042.83 | 6,522,384.28 |

*(The total Point Roberts valuation for the Fire District is slightly different at $625,439,068.)

Point Roberts overall, with a total valuation of about $625 million, pays about $6.5 million in total property taxes. Since the overall property tax revenue across the county is about $324 million, Point Roberts contributes less than 2% of Whatcom County's total property tax revenues.

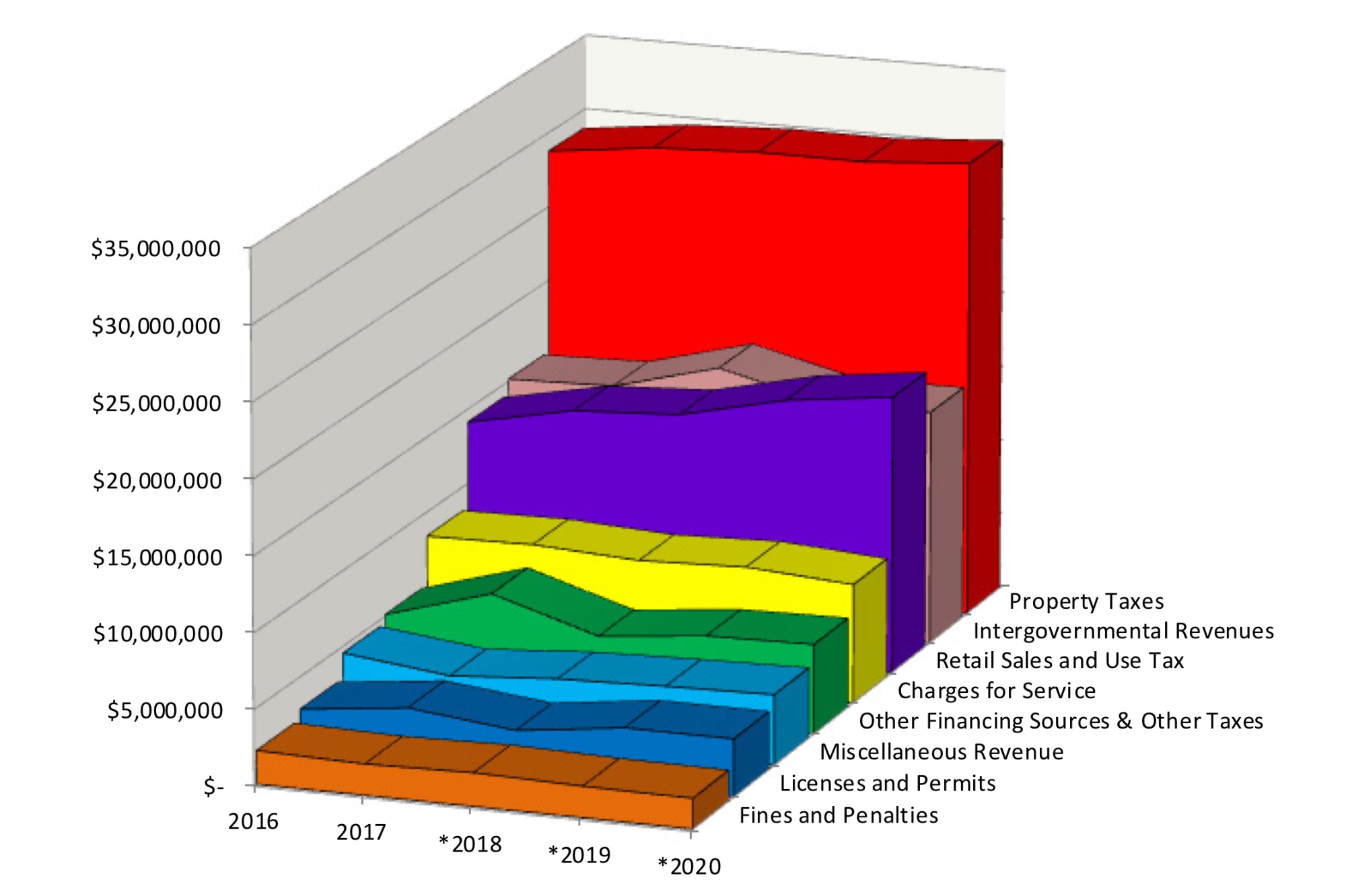

Property taxes make up just part of the county's total revenues. Here's a chart from the County Executive's budget showing the relative contributions of the various tax sources to the county's general fund:

If you prefer numbers:

(The Property Taxes line item of $29 million above differs slightly from the $30 million figure we've been using because this budget was prepared several months before the full amount of property tax levies were approved.)

Out of $324 million total property tax revenues at the county level, only about $30 million go into the county general fund. Of that $30 million, Point Roberts contributes $591,863.70, or 1.94%. We pay less into the county general fund than we pay for county roads, either of the two schools line items, or the Fire District.

About a third of the county general fund revenue comes from property taxes. The other two-thirds come from other sources. So property taxes cover just a third of the services we receive from this general fund.

Now that can see how much revenue the county receives from us and how, we will look next at how the county spends those funds.

This post will probably be updated after we receive corrections from our friend and chief fact checker Mark Robbins, who actually does know a lot about this.

Jump to Part 2 here.

New comic every Monday